Articles connexes

Comment Finalyse peut vous aider

IFRS 17 Validation

IFRS 17 will be effective from 1 January 2023 and it will change the recognition, measurement, presentation and disclosure of insurance contracts. It directly impacts how insurers value their insurance liabilities and recognise profits.

Insurers must define methodologies for non-prescribed items such as discount rate, risk adjustment, contract boundaries. New systems must be developed to handle data, perform calculations and generate accounting ledger entries.

Comment Finalyse peut vous aider à relever ces défis ?

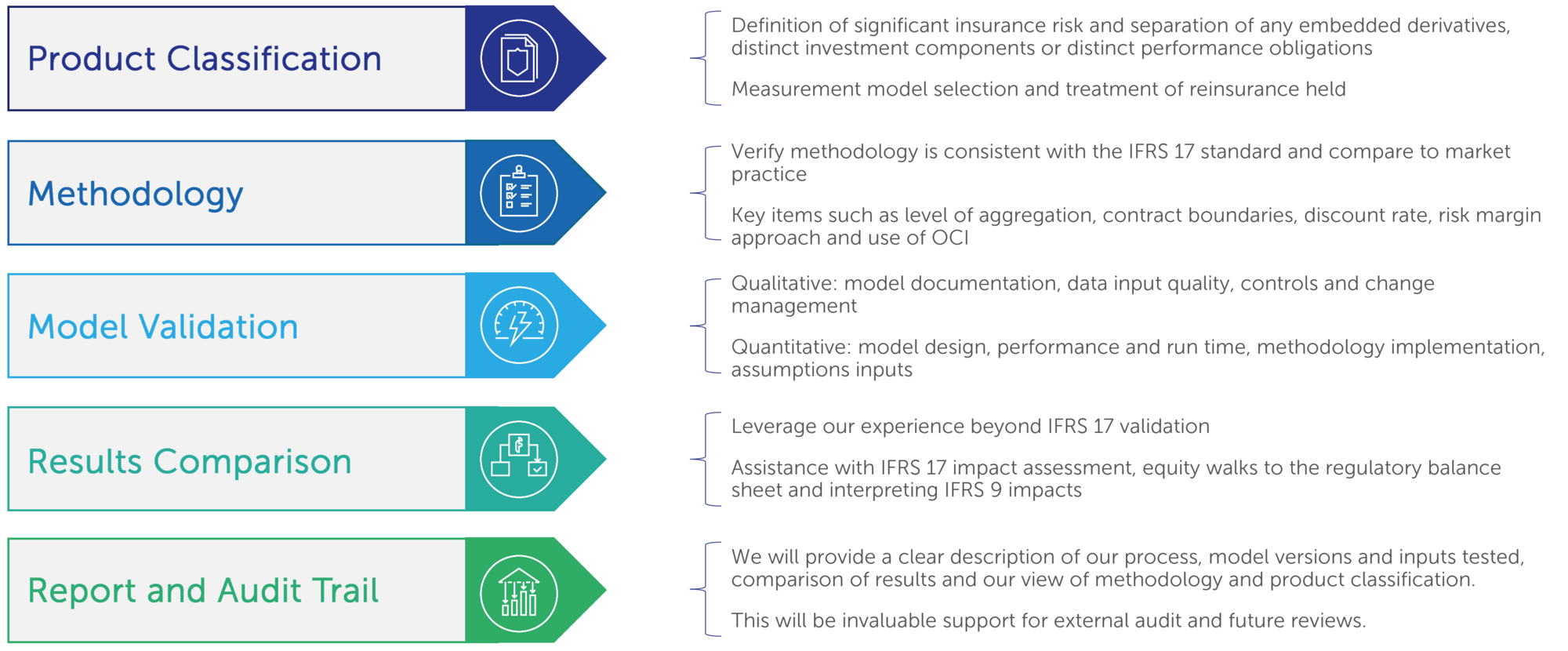

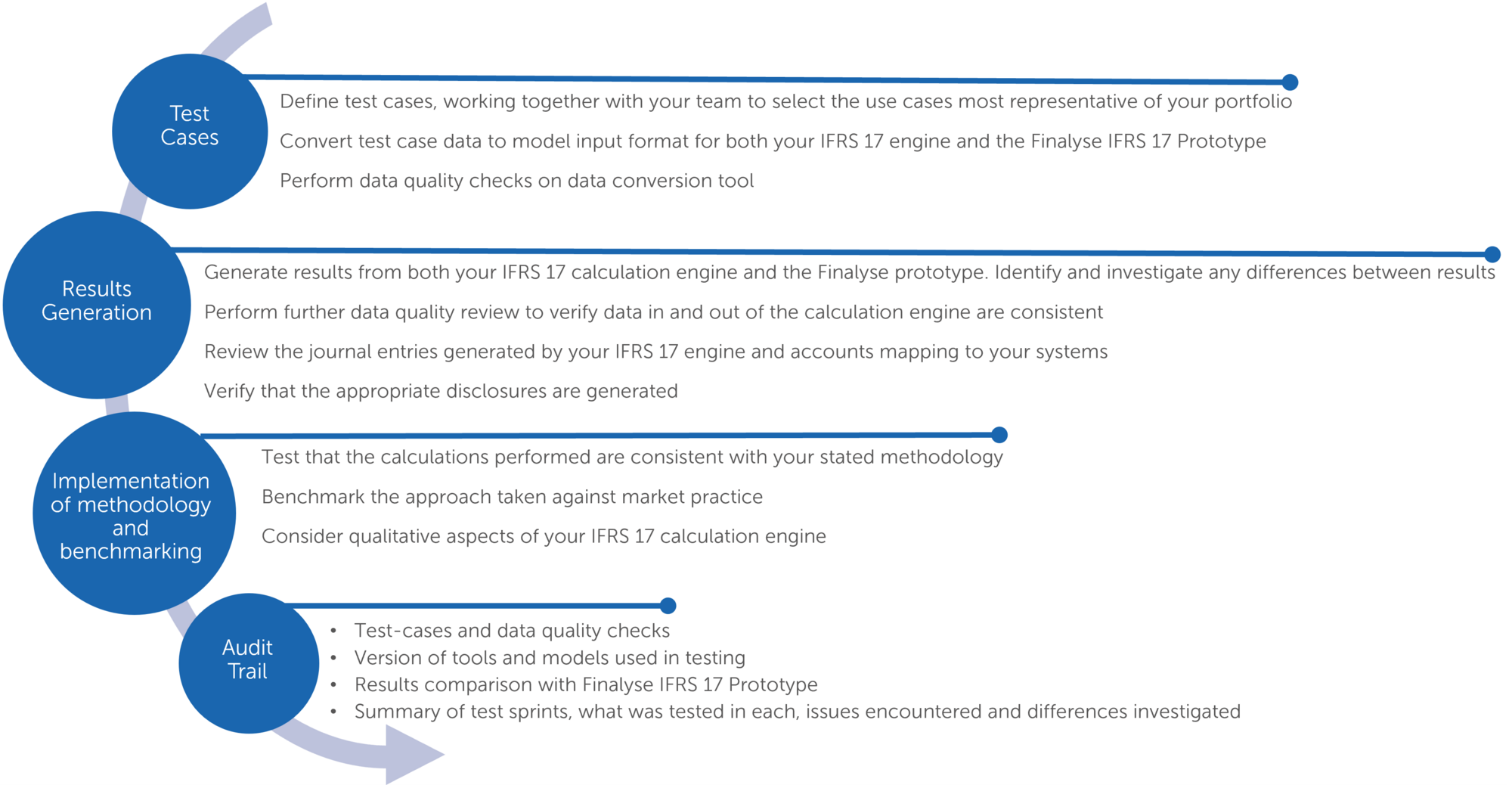

Validation of your entire IFRS 17 landscape.

Including methodology, configuration and output from accounting engine (cashflows, journal entries and disclosures) which helps provide assurance and identify any gaps in your process.

Our in-house IFRS 17 Toolkit includes:

- CSM Actuarial Prototype

- CSM Generator

- New business generator

- BS Generator

- P&L Generator

- Risk adjustment prototype

- Pre-defined use cases for validation

Independent model validation review.

Setting key design principles, assessing implementation of the methodology, data, assumptions and documenting results.

Assistance in performing your parallel runs and reconciliations with the current IFRS 4 and with the solvency balance sheet

Technical and process recommendations and benchmarking will allow you to refine your approach ahead of transition

Audit Trail with clear documentation of our independent validation process which can be used as support for external audit and future reviews

Key Features

- The introduction of the IFRS 17 standard will bring increased scrutiny from external audit and management. Independent validation from Finalyse provides assurance and will give you a view of how your approach compares to market practice.

- Our experience in model implementation, testing and configuration allows us to have an efficient approach to validation. This approach includes an established testing method, pre-defined use cases, our in-house IFRS 17 Toolkit, pre-defined validation policy and process.

- Working with Finalyse, you will gain insights into the key profit drivers under IFRS 17 and support in developing your Management Information and KPIs under the new standard.

- Finalyse has a business acumen in areas beyond financial reporting, such as actuarial models, IT systems (data management and storage capacities), risk management (ALM and hedging, product design) business strategies and remuneration.

Frans is an actuary and Financial Risk Manager with international experience in the pensions and insurance sectors. He has been specialising in actuarial valuations (AXIS), financial and regulatory reporting (IAS19, US GAAP, IFRS2, IFRS17), regulatory reporting (IORP II, Solvency II, ICS, BMA), market risk management (ALM, SAA), climate change risk management and investment consulting.

Divyank is a Senior Consultant with more than 8 years of experience and a part qualified Actuary. He has acquired expertise in Solvency II, IFRS17 and MCEV reporting and has worked for life and non-life business. He has extensive experience in Prophet modelling, DCS, statutory valuation and IFRS17 implementation and his coding skills include Prophet and DCS modelling, SAS, VBA, R.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support