Comment Finalyse peut vous aider

AI Fairness Assessment

Responsible AI is a serious concern for European regulators. AI drives innovation by enhancing decision-making and efficiency across all industries, finance makes no exception. However, challenges like data privacy and bias have led European regulators to ensure AI prioritizes fairness, human rights, and accountability, fostering responsible use while minimizing risks. In a nutshell, this is the spirit of the EU AI Act (enforced in August 2024) that wants to ensure a safe use of AI systems.

The adoption of the EU AI Act highlights the increasing regulatory focus on ensuring AI models are ethical, fair, and transparent. Financial institutions face mounting pressure to assess and demonstrate the fairness of their AI models, particularly in areas such as credit risk scoring, transaction monitoring, and customer interaction. Companies are expected to comply with EU AI Act by August 2026.

The European Commission will most likely expect all financial organisations to integrate in their risk management framework and ESG reports an AI Fairness assessment and support in AI conformity assessment.

Comment Finalyse peut vous aider à relever ces défis ?

Governance

Risk-level identification of AI risk system and integration of responsible AI report into the risk management framework and systems.

Perform AI conformity assessment

Ensure that the use of AI systems is lawful, ethical and technically robust.

Monitoring and maintenance

Performing periodical reviews and updates of the AI conformity assessment report.

Comment cela fonctionne-t-il en pratique ?

Finalyse offers a comprehensive AI model fairness assessment service aligned with the requirements of the EU AI Act.

Our service combines both quantitative and qualitative evaluations to assess key metrics such as fairness, bias, transparency, and accountability, while ensuring full regulatory compliance.

We support clients in various aspects of preparing for the EU AI Act conformity assessment, including:

- Identifying risk levels for AI systems

- Implementing AI governance frameworks

- Performing gap analyses and recommending improvements

Our methodology is aligned with the CapA conformity assessment procedure (as outlined in capAI.pdf), a structured tool designed to audit AI systems. Finalyse has previously applied similar internal review protocols for several clients.

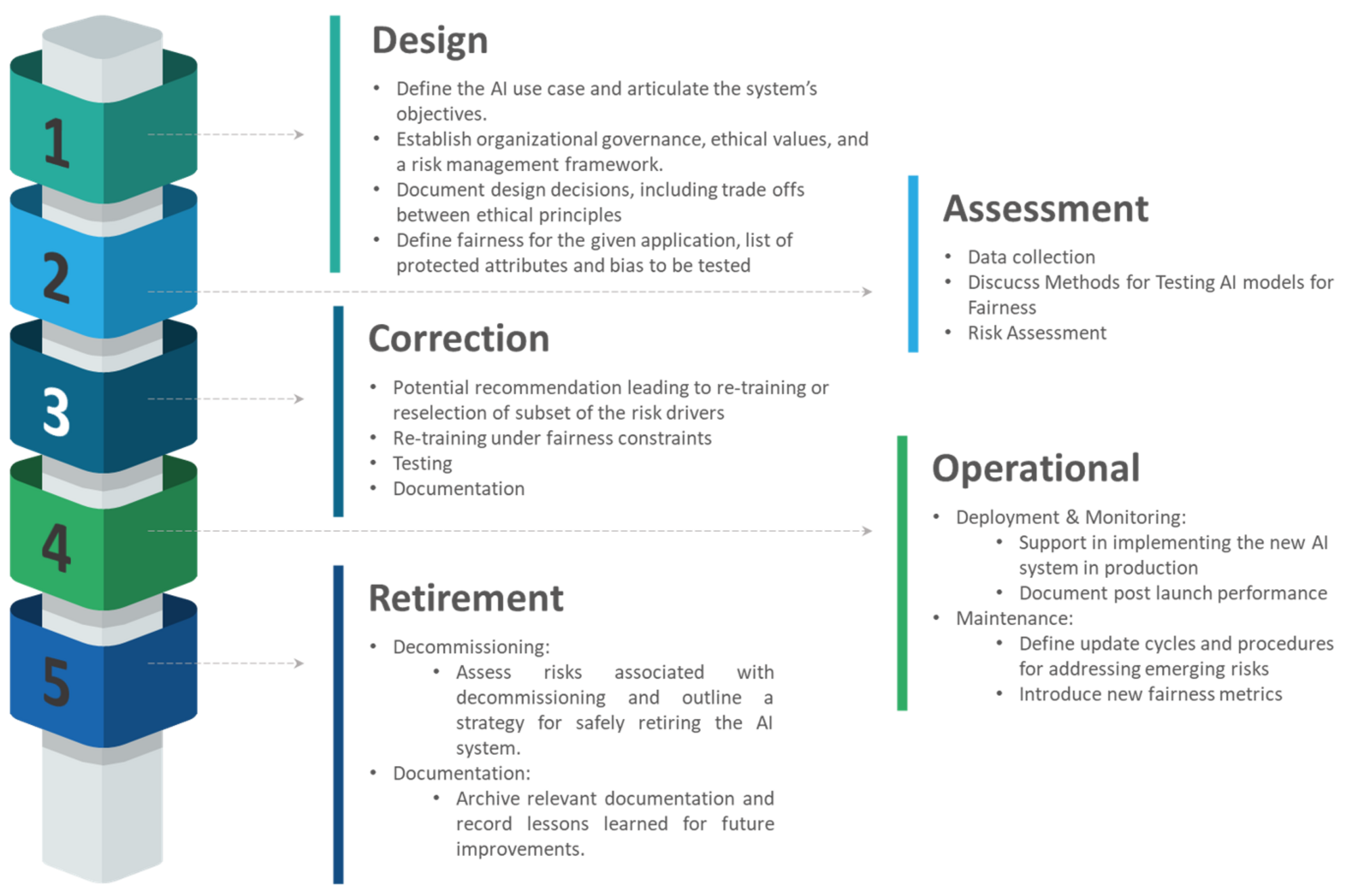

The assessment process is structured into the following key stages:

Key Features

- Enhanced confidence in the fairness and compliance of AI models.

- Mitigation of reputational and regulatory risks associated with AI biases.

- Improved alignment with ethical AI principles, fostering trust among stakeholders.

- A competitive edge in meeting and exceeding EU AI Act requirements.

- Customised support from experts familiar with both regulatory frameworks and AI technologies.

Nemanja Djajić is a Managing Consultant with more than 12 years of experience in credit risk modeling and data science area. He gained his experience through multiple roles in banking industry including the position of data science department director in one of the biggest banks in Eastern Europe. Nemanja’s main area of expertise lies within the development and validation of risk and business related models, using traditional or machine learning methodologies.

Marino is a Senior Quantitative Risk & Machine Learning consultant at Finalyse. He is a qualified actuary with 7 years of experience. He has successfully delivered several projects for banks and insurance companies including a conversational chatbot, AI-powered price optimisation engine, Deep Learning time-series forecast models, challenger software for Credit Risk, AML, and PEP models for traditional and fully digital banking. His expertise extends to non-life insurance pricing, risk modelling, and regulatory frameworks such as IFRS and Solvency II. He is proficient in Python, Linux, Docker, Flask, GCP, Azure, AWS, and various other tech stacks.

Gergely Tréfa is a Senior Consultant at Finalyse with more than 5 years experience in credit risk model development, validation and data science. He has extensive experience in developing and validating PD, LGD, EAD models under IRB and IFRS frameworks. Gergely holds a Master's in Quantitative Finance and is proficient in R, Python, and SQL. In addition to regulatory modeling, he has developed non-regulatory machine learning models, such as collection and prepayment models, and has applied NLP techniques to automate risk reporting processes.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support