Finalyse RWA SmartCheck

Finalyse RWA SmartCheck is a Python-based redevelopment of the CRR3 Validation Toolkit, designed to deliver high-speed simulations and granular impact assessment for capital-floor requirements.

Users can modify input parameters, methodological assumptions, or portfolio structures and obtrain an instant preview of the resulting RWA and capital impact. The tool supports full-scope standardised and IRB RWA calculations and is fully aligned with the evolving CRR3 regulatory framework.

Delivered with expert assistance for installation, data ingestion, and configuration, RWA SmartCheck provides a flexible environment for continious capital-optimisation analysis.

Comment Finalyse peut vous aider à relever ces défis ?

Run SA on entire portfolio

- Business rules defined as per CRR3 and Basel IV Standardised Apprach

- Removes the effort on user-defined test cases

- Benchmarking for output floor

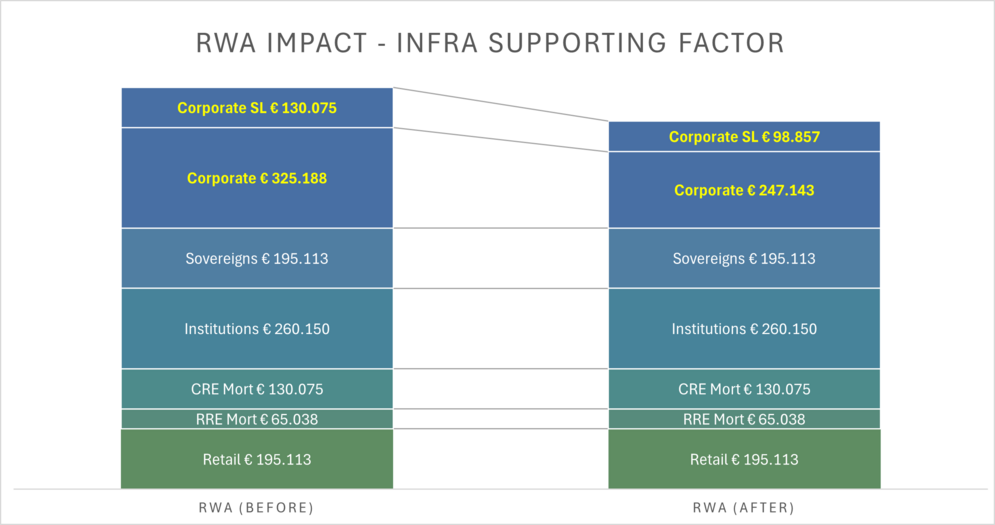

Optimise your RWA

- Perform allocation of credit risk mitigants to simulate RWA reduction

- Gauge specific dimentions contributing to RWA optimisation for strategic decisioning

Customise as you need

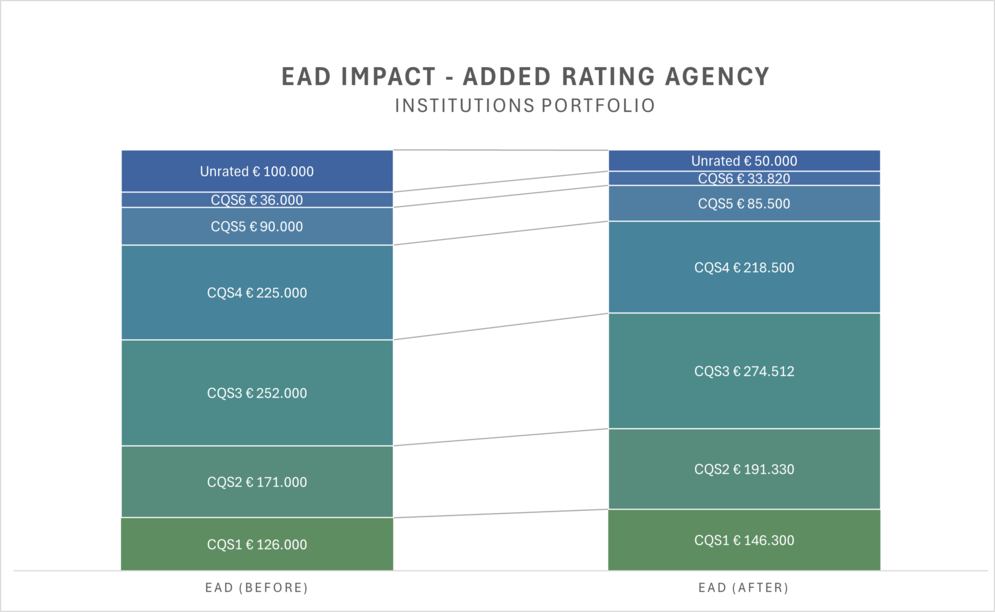

- Add/modify dimensions "outside" the Basel IV calculation standards for impact assessment- ex: Mortgage floors prescribed by local regulators

Fully Transparent

- Get a complete view of all the calculation rules as specified in the regulations

- Traceability for audit/validation purposes

Leverage Test Cases Simulator

- Open-source (R-based) test cases generator for easiest modifications

- Asset class specific dimentions can be added easily

- Skew the number of test cases based on the bank's actual portfolio

Exposure-class dimensions

- For corporates, view SME and Specialized Lending level results

- For retails, view transactor info

- For Mortgages, get Whole Loan vs Split Loan results

Comment cela fonctionne-t-il en pratique ?

Finalyse RWA SmartCheck performs Standardized calculations on the entire portfolio of the bank, which is used for the output floor as stipulated by the regulation. With this toolkit, leverage Finalyse’s CRR2 and CRR3 test cases simulation engine for generating exhaustive test cases covering the bank’s portfolio.

In essence, the tool works in the following ways:

- Reads input text files with integrated data model for the calculation engine. Alternatively, leverage open-source code to transform into use cases for validation

- Performs Standardized RWA calculations for different configurations (CRR2, D424 (Basel IV), CRR3) with credit-risk mitigant allocation

- Demonstrates each stage of workflow and produces compatible output for comparing results

Key Features

- Computes full Standardized run calculations for the entire portfolio

- Provides the ability to compare both CRR2 (Basel III) and Basel IV/CRR3 results – perform faster validation for CRR3 implementation

- With the open source (R-based) test cases generator, create exposure-class specific test cases complying with CRR2/CRR3 guidelines

- Add local regulator aspects (ex: Mortgage floors) in the tool and customize freely

- Generate comparison reports for impact assessment of moving to CRR3/Basel IV

Abishek Chopra is a seasoned Risk Management professional with over 12 years of experience in multiple areas of credit risk, especially on CRR and Basel guidelines. He has expertise in addressing complex regulatory topics such as credit risk mitigation for RWA optimization of different asset classes, Basel IV application of Whole Loan/Split Loan approaches for mortgages, SA-CCR and Securitisation.

Nathan Desmidt is a Managing Consultant with more than 8 years of experience in risk management. Nathan’s area of expertise lies within regulatory capital calculations, specifically in the context of CRR2/CRD5 and upcoming Basel 4/CRR3 regulations. Recently Nathan has been involved in the implementation of a new RWA calculator at a large financial institution aiming to enable Basel 4 compliancy, focusing on validation of RWA calculations in light of the new framework’s developments.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support