Comment Finalyse peut vous aider

Comprehensive yet pragmatic solutions for your major challenges

Introduction

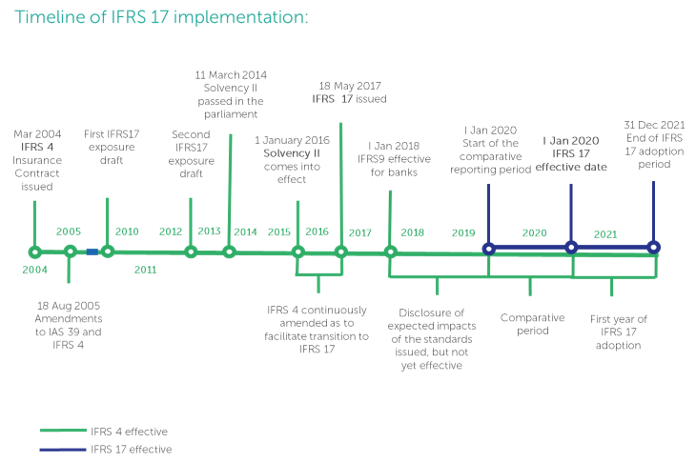

The IFRS 17 regulation is to become effective on 1 January 2021, replacing the interim Standard— IFRS 4. At this point, the precise effects of these standards are as yet unclear. However, as we know the final form in which the standards were released this May and we have (dare I say) an apt understanding of the regulatory framework currently at work, we can already make several educated guesses – guesstimates if you will – on the sort of impact that the standards may have on insurance companies and more broadly on the asset management industry. On a general level, these remarks should be correct, but indi- vidual insurers are still advised to take them cum grano salis.

What will change?

IFRS 17 is designed to improve on its predecessor IFRS 4 in two major ways:

- It makes sure that more transparent, more useful and ultimately, more precise information is provided by the insurers on the value and profitability of their operations.

- It creates a framework that applies the same rules across different nations, different insurance contracts1 and different industries.

Because IFRS 4 allowed different insurance contracts to be measured across different jurisdictions and by different firms in very different manners and IFRS 17 creates much needed unified framework, or at least takes a large step towards its unification, the path to IFRS 17 compliancy is going to differ from firm to firm based on what sort of insurance contracts they issue and especially how they used to measure them until now.

It would be a mistake to see the changes in the European regulatory environment as a simple matter of IFRS 17 succeeding IFRS 4 (even though IFRS 17 was indeed conceived as IFRS 4 phase 2). As with any succession, there are cousins and illegitimate offsprings that want their say, invariantly leading to some conflicts. A number of deficiencies and shortcomings of IFRS 4 that IFRS 17 remedies were already addressed by Market Consistent Embedded Value Principles (MCEV) and Solvency II and these regulatory pieces are not going to depart from the scene just because IFRS 4 did. They will be to some degree at odds with IFRS 17.

There are many novelties brought to the table by IFRS 17, which Europe has already been feasting on for some time. IFRS 17, Solvency II and MCEV all require the use of the best estimate cash flows to value policyholder liabilities; they all try to impose the discount rates that are consistent with the market and they make use of similar principles to measure the uncertainty in timing of the cash flows. Unfortunately, the way IFRS 17 implements these is not always exactly the same as what the aforementioned regulations do.

1 Please note that IFRS 17 applies not to the actual insurance firms but to the insurance contracts. As such, it does not necessarily encompass all items on balance sheets of insurance companies and may affect balance sheets of predominantly non-insurance companies

- Whilst all use best estimates of future cash flows, unlike in Solvency II and MCEV, general overhead expenses that cannot be directly attributed to portfolios of insurance contracts cannot be counted among IFRS 17 fulfilment cash flows.

- IFRS 17 discount rates are principle-based and can be estimated using a bottom-up or top-down approach2. Solvency II applies a strictly prescribed methodology using adjusted risk-free rate based on swap rates. MCEV is principle-based, but uses the bottom-up approach only.

2 In a bottom-up approach, the insurer captures the characteristics of the cash flows by starting from a risk-free discount rate and adding to that rate an adjustment to reflect the extent of illiquidity present in the group of insurance contracts. In a top-down approach, the insurer reflects the characteristics of the cash flows by starting with the expected current market return on assets and deducting from that expected current market return the premium that market participants require for bearing the risks that are associated with those asset returns but are not present in the liability (or are excluded from the measurement of the liability).

Apart from what these regulatory pieces have in common but use differently, there are some more significant differences:

- IFRS 17 spreads the profits from an insurance contract throughout its entire duration using the Contractual Service Margin (CSM), while Solvency II and MCEV recognize the profits immediately.

- The requirements of IFRS 17 (like those of MCEV) are more principle-based and less prescriptive then Solvency II, allowing companies somewhat more freedom to choose their own approach.

- While IFRS 17 is thought to be a performance reporting metric, Solvency II is centred on the principles of the capital requirements.

- Additionally, the actual way in which reporting is done in IFRS 17 is very different. Many companies will be required to enhance their reporting systems in order to meet IFRS 17 reporting requirements, even if they are up to date with Solvency II and MCEV.

What to expect?

Looking at the standard from an implementation costs perspective, these are going to be substantial for most firms, notwithstanding that the basic requirements regarding data, structures, auditability and traceability of processes and supporting systems are the same as or similar to what they are for Solvency II.

An attempt was made, when drafting the standards, to make sure the costs would not be completely prohibitive. Therefore:

- The measurements regarding short-term (1 year) insurance contracts were simplified

- Standards should apply to groups of contracts, not specific contracts individually (this is going to decrease costs, especially to bigger insurers)

- Some types of common contracts (warranties) are left out of scope

These simplifications in general favour short term contracts. The life insurers will, by the virtue of their long term commitments and assets, find the transformation more painful than non-life ones, also considering the strong connection with IFRS 9.

What exactly are the insurers getting out of this?

As has been stated before, insurance contracts can be treated in bundles (of same types of contracts), not individually. The unification of standards has been essential and may actually substantially facilitate things, particularly for multinational companies. Also, the demands on the declared revenue to reflect the insurance coverage provided, excluding deposit components, are consistent with demands in other industries.

Moreover, the insurers’ books will better reflect their profitability and value of obligations as well as the effects that changes in market conditions have on both. Whilst this may not necessarily benefit the insurers themselves by providing them with clearer information on their businesses, because the disclosed information will not only be clear and revealing, but also comparable across different jurisdictions and sectors, the clarity with which capital markets view insurers will improve. This could make the insurance industry more attractive for the investors and facilitate the allocation of capital therein.

From a capital and performance management perspective, the industry will benefit from IFRS 17 as the standard finally enables to reconnect measurement models with risk and capital management. Nowadays it is seemingly irreconcilable that performance standards (local GAAP or US GAAP) foresee the measurement of insurance liabilities generally based on locked-in assumptions (or amortized costs) while Solvency II Market Value Balance Sheet (MVBS) calls for the measurement of liabilities based on prospective and stochastic valuation principles. It is somewhat puzzling that the misalignment of the project timelines of Solvency II and IFRS 17 has resulted in the development of two separate balance sheets with lots of reconciliation issues. This disconnection in measurement models and the absence of income statement under MVBS make it extremely challenging to explain capital changes nowadays.

IFRS 17 brings here the opportunity to reconcile capital and performance measurement. Going one step further, and making a somehow strong assumption that EIOPA would accept a more principle-based accounting framework as a basis for Solvency II, the use of an IFRS balance sheet as a basis for Solvency II would then lead to substantial alignment and clarity gains.

The more aligned level of information will finally facilitate the work of regulators, enabling them to take timelier and better informed actions.

IFRS 17 and its connection with IFRS 9

With IFRS 9 looming ahead, IFRS 17 compliant firms may take advantage of a temporary exemption from the adoption of IFRS 9 and adopt the standards simultaneously. In many ways, this seems to be a wise choice. In a nutshell, IFRS 9 provides a new approach on how to classify financial instruments based on their cash flow characteristics and the business model under which they are managed. Furthermore, the standard introduces a new impairment model for debt instruments and provides new rules for hedge accounting. It can be assumed that the main impact from IFRS 9 for insurance companies will arise from the new classification rules leading to more financial instruments being measured at fair value through profit and loss as well as from the new impairment model. In this context, interdependencies with IFRS 17 must be considered to come to a final conclusion on the combined impact of both standards.

Taking a very high-level look at the interdependencies, the IFRS 9 reporting on the one hand is designed to reflect the changes in economic value of the financial assets (debt instruments) either in OCI or in P&L, and thus impacts the valuation and income recognition of assets (chiefly with increased volatility). IFRS 17 reporting on the other hand is designed to reflect the changes in the economic value of the insurance contracts attributable to the changes in discounting (i.e. interest rate risk) either in OCI or in P&L. Therefore, IFRS 17 chiefly affects the liabilities of the insurers.

IFRS 17 applies on the liability side a similar set of principles, definitions and approaches as IFRS 9 does on the asset side. The portfolios of insurance policies and their covering assets are defined similarly by both standards. Both reflect the understanding that the economic value of assets will not be solely driven by interest rate risk, and that the economic value of insurance policies will also be subject to changes in the underlying pricing assumptions.

Applying these principles on one side of the balance sheet, but not on the other may lead to substantial imbalances. Thus it is more than advisable, for the sake of the balance sheet, to tackle the implementation of IFRS 17 in parallel with the implementation of IFRS 9. For instance, the implementation of IFRS 17 together with IFRS 9 will offset (in part more likely than in full) an increased P&L volatility on P&C and other Life contracts due to the way IFRS 9 classifies the equity-type and structured instruments, and thus avoid asset-liability mismatch. Starting from existing assets and liabilities positions, an adequate portfolio restructuring might be considered, leading to interesting ALM challenges during the implementation phase of these standards.

Concluding remarks

It is generally admitted that the implementation of the standards by the market players will be challenging-their development, after all, has been a long and thorough process. It nevertheless provides an opportunity to re-design and improve legacy processes and value chains as well as unify metrics and data flows. Finalyse believes that the completion of this exercise must be undertaken as far as to fully meet the ambition of reconnecting performance and risk management systems and metrics. Adding to it the perspective of having assets and liabilities managed under the same rules and cockpit, the new standards bring a unique opportunity to deploy understandable and complete management systems.

Finalyse is ready to support you in these trials.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

CONSENSUS DATA

Be confident about your derivative values with holistic market data at hand

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support