Articles connexes

Comment Finalyse peut vous aider

INDEPENDENT VALUATION OF PRIVATE EQUITY AND DEBT

Valuation is the cornerstone of the private equity Industry as it impacts the main actors of this market: LPs, GPs and supervising authorities. A fair valuation can be challenging to justify when the valuation is provided by a party that is also interested in the performance of the investment (e.g., GPs).

Getting a fair valuation of your private equity or private debt instruments can be costly and time-consuming. The onboarding of an external party can bring an independent aspect to your valuation and provide confidence while avoiding conflicts of interests issues.Each Private Investment case is different and we endeavour to fit to each specific situation in order to provide bespoke solutions.

Comment Finalyse peut vous aider à relever ces défis ?

Valuation

Valuation of all types of private investments: equities, loans (convertibles, mezzanine, structures, etc.).

Due diligence

A due diligence process at the inception of a deal or for a year-end exercise.

Market data

Gathering all market data: transactions (when available), FX rates, equity volatility, yield curves and credit spreads.

Compliance

Compliance with regulations: AIFMD, EUVECA, etc.

Best market practices

We follow the International Private Equity and Venture Capital Valuation (IPEV) guidelines.

Support

We provide support and follow-up explanations in case of need.

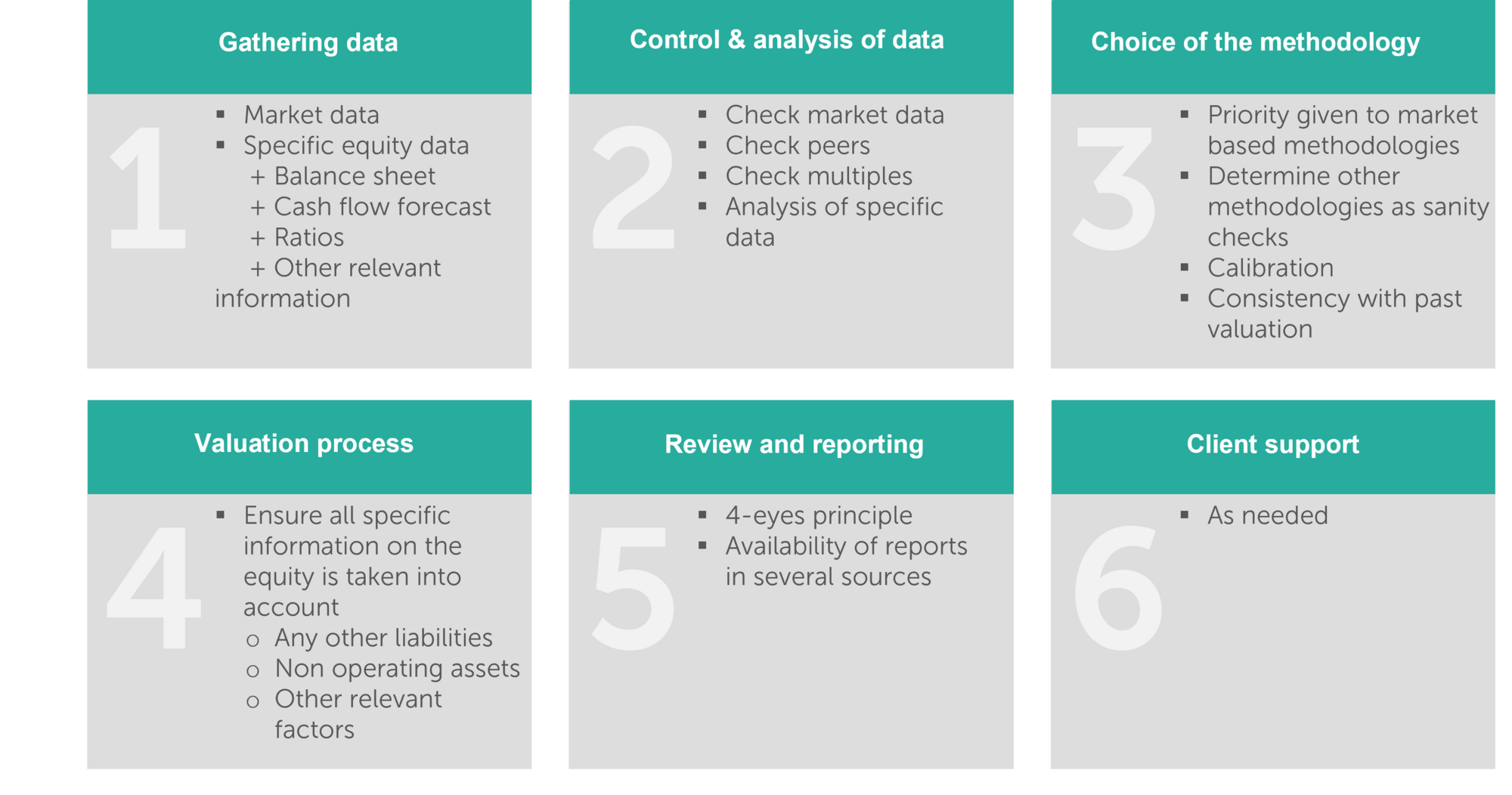

Comment cela fonctionne-t-il en pratique ?

To avoid any conflict of interests, Finalyse offers you its independent due dilligence and valuation service, with the following main aspects:

- Various approaches (public multiples, DCF, recent transactions, impairments, option based).

- Independent and consistent computation of NAV over time.

- Compliance with regulations (AIFMD, EuVECA).

- Best market practice (IPEV guidelines).

- One-stop-shop for the valuation of private equity, OTC derivatives and structured products.

- The service is enhanced with a fully documented justification of the price.

- Quarterly presentation of prices to the valuation committee (if needed).

Key Features

A sound and detailed valuation report

- Risk dashboards linked to a valuation (stress tests, sensitivity to market data, scenario analysis) at portfolio or position level

Open dialogues with Investment managers as well as full transparency of the process

The service is enhanced with fully documented justification

Specific support can be provided on request from auditors, regulators, or shareholders

Ali, Partner at Finalyse, joined Finalyse in 2008 and founded the Valuation Services department.

With 25 years in the financial industry, including senior roles at top European banks, as head of structured products.

Now leading Valuation Services, Ali drives strategy and business development, adapting to market demands and client needs.

He's widely respected at Finalyse as an expert in Structured Products and OTC Derivatives, providing clients with advanced solutions in a dynamic financial landscape.

As part of Finalyse’s alternative investments valuation team, Silvio evaluates alternative financial products, such as ABS, MBS, etc. He contributes to the set up of new financial instrument valuation models and performs Due Diligence before investment and ongoing. Silvio also performs the valuation of private equity and private debt instruments of dedicated investment funds, using different methodologies to evaluate the funds underlying companies on an ad-hoc basis, primarily market-based and DCF models, including scenario analysis and stress tests.

Client Testimonials

We provide valuation and due diligence services to asset management firms that need to use the fair value of their PE investments. We offer a recurrent semi-annual valuation of portfolios for the computation of NAV. We also act as independent advisors for the evaluation of the fair value of private equity and private debt instruments on a case-by-case basis. We finally provide due diligence reviews during the investment process (or during the life of investment) into private projects and deliver a piece of final advice on all risk management aspects. This includes, among others, liquidity analysis, market risks (peers’ analysis, forex, interest rates), country risk, suitability of the vehicle and consequences, exit aspects and fair valuation.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support