Articles connexes

Comment Finalyse peut vous aider

Finalyse Risk Data Analyzer

Finalyse Risk Data Analyzer addresses critical business needs with its two primary modules: the Data Management Module and the Risk Analyzer. These modules support the following use cases:

- Automated Regression Testing in a project-based environment for seamless updates and system validation.

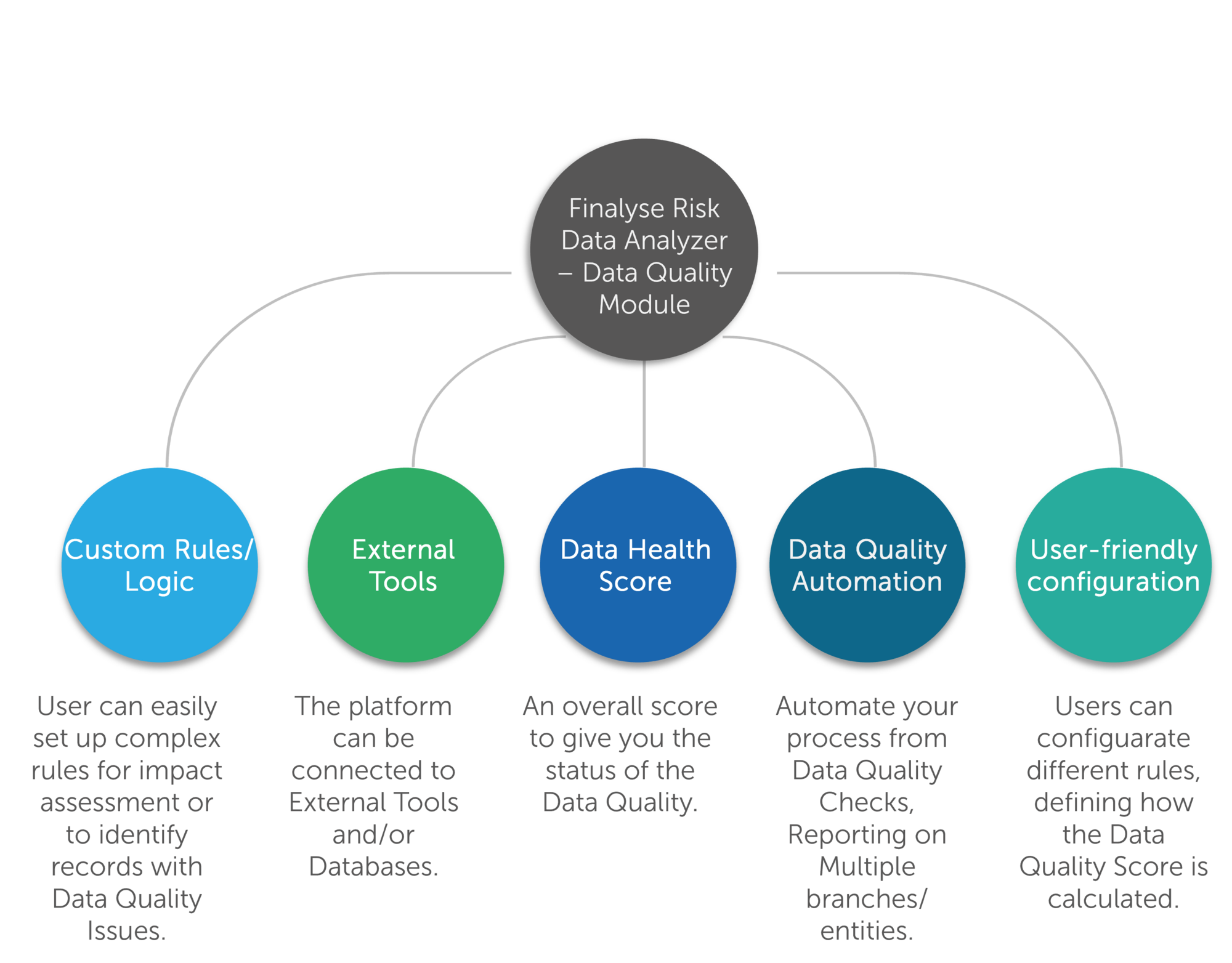

- Data Quality Automation and Data Health Scoring tailored for the Banking and Insurance sectors.

- RWA Impact Assessment across all methodologies (SA, F-IRB, A-IRB) for accurate regulatory compliance.

- Spread Risk Capital Assessment & Best Estimate Liability Impact Assessment for Insurance Entities

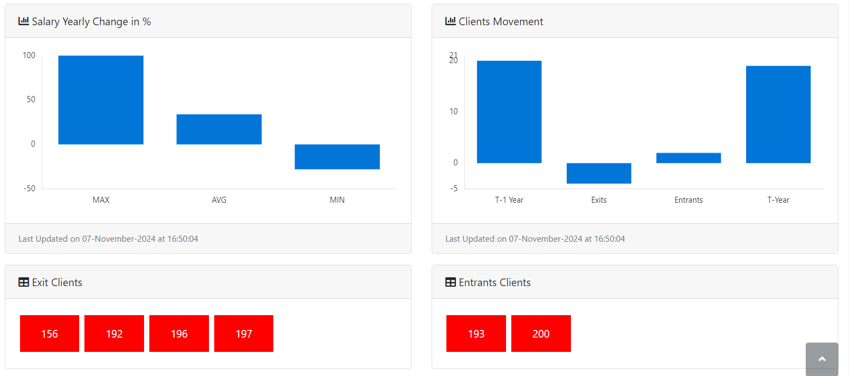

- Fully Customizable Dashboards designed to meet the specific needs of different stakeholders.

Comment Finalyse peut vous aider à relever ces défis ?

Reduction in Manual Processes

Automates repetitive and labour-intensive tasks, freeing up resources for strategic analysis and decision-making.

Enhanced Data Quality and Integrity

Automated data quality checks ensure that the data used for analysis and reporting is accurate and reliable.

Improved Regulatory Compliance

Provides tools to efficiently manage and assess regulatory requirements, reducing the risk of non-compliance.

Increased Efficiency and Speed

Accelerates processes such as regression testing and RWA assessment, leading to faster project completion and timely reporting.

Flexibility and Scalability

The modular architecture allows clients to select and use only the necessary components, making the platform adaptable to varying needs and scalable as requirements grow.

Expert Integration

Combines deep expertise in the Financial Risk Domain with advanced technological solutions, providing a robust and reliable platform.

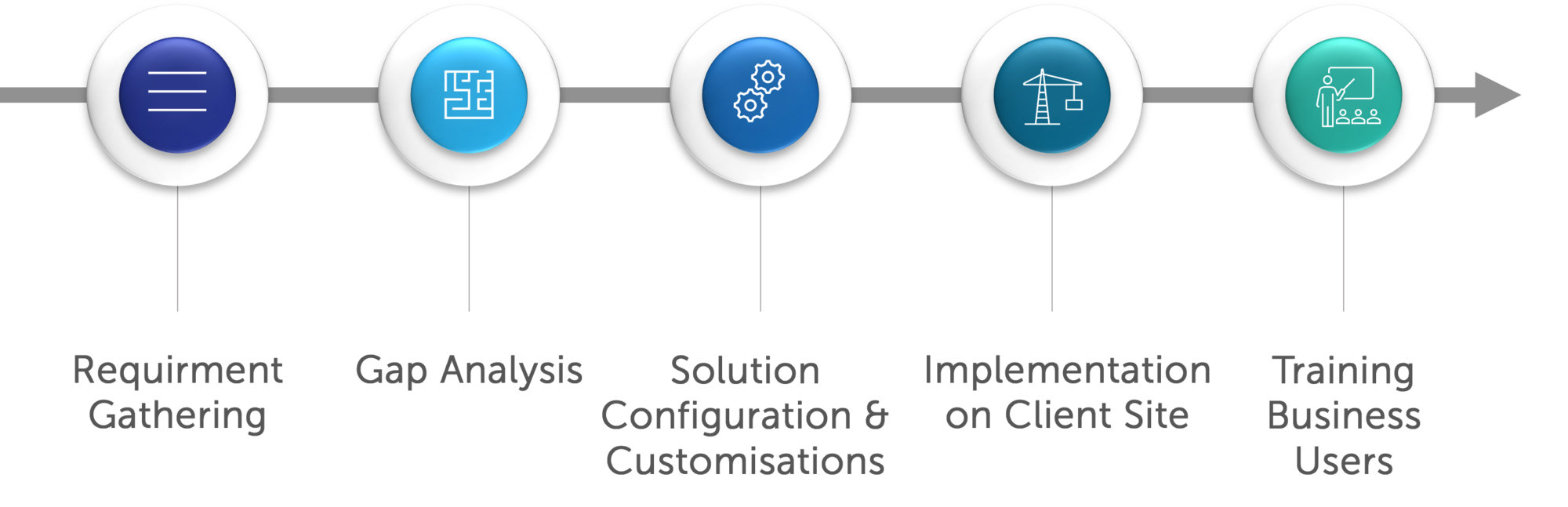

Comment cela fonctionne-t-il en pratique ?

Data Quality Module

Risk Analyzer

- Drilldown Analysis to better assess on portfolio, sub-portfolio and deal level.

- Impact Calculation in order to assess data quality issue impact(Data Quality Module) or RWA Impact(RWA Analyzer)

USE CASE: RWA

- Import Calculation Risk Data Mart on Deal Level.

- Configure all the new Risk Parameters to be applied (like Probability of Default, LGD).

- Recalculate RWA on the Finalyse Data Analyzer.

- Check the results on the Dashboard on portfolio level or drill down on Deal Level to see the impact of each Risk Driver on the new Risk Metrics Result.

USE CASE: Insurance Spread Risk Capital

- Import Calculation Risk Data Mart on Deal Level.

- Configure all the new Parameters to be applied (like External Ratings).

- Recalculate Spread Risk Capital on the Finalyse Data Analyzer.

- Check the results on the Dashboard on portfolio level or drill down on Deal Level to see the impact of each parameter on the new Risk Metrics Result.

Key Features

- The solution comes with pre-built reporting templates, calculations logics and dynamic configuration that can be easily adapted for client's specifics needs

- Easily map data from different sources, build data validation rules and fallback rules.

- Drilldown based on Hierarchy Configuration (for example from Corep Asset Class -> Product -> Entity Type)

- Customize dashboards with the KPIs most relevant to the client. Drag-and-drop functionalities to make dynamic dashboards

- Benefit from the expertise and experience of Finalyse consultants in implementing automated end-to-end Solutions

Besion Kolli is a Senior Consultant in Financial and Risk Analysis with expertise in Business Analysis, Credit and Market Risk, and Project Management for the implementation of risk software solutions. He specializes in extracting, analyzing, and reporting financial data from diverse accounting and information systems and in developing advanced risk models. Besion’s technical proficiency includes SQL, Excel, and Python, which he leverages to provide comprehensive risk assessments. Additionally, he has extensive knowledge of Risk Authority Software, which is used for Regulatory Risk Reporting and Calculation. His project management experience includes overseeing the implementation of risk software, ensuring that solutions are delivered efficiently, within scope, and compliant with regulatory requirements.

Hugo is a Principal Consultant in Finalyse Brussels. He has a wide knowledge and expertise in financial products, valuation algorithms, reporting and regulatory issues. He combines in depth knowledge of banking financial risks and regulations with a wide understanding of the data, IT infrastructure and processes underneath. Hugo has been involved in multiple Risk and Regulatory Reporting implementation projects such as RWA calculation for credit risk, EAD calculation under SACCR, automation of internal reports for ALM and implementation of data governance to comply with BCBS239. Hugo is an experienced Agile project manager who stands-out for his dynamism, adaptability and interpersonal skills.

Belinda Pllaha is a managing consultant with over 10 years of experience in credit risk management, specialising in the implementation of key regulatory frameworks such as Basel IV and IFRS 9. She has a strong background as a functional analyst, conducting impact analyses, business analysis, and driving the implementation of risk management tools and systems. Belinda combines technical expertise in Excel, SAS E.G., SQL, and Risk Authority from Moody’s with an in-depth understanding of regulatory reporting and process optimisation.

Vjola Himaj is a Senior Consultant with expertise as a business and functional analyst and project manager in banking, with in-depth knowledge of banking applications and processes specialized in risk reporting. Her technical expertise includes SQL, Microsoft Access, Risk Authority, Oracle tools such as Flexcube and Oracle Banking, the Temenos T24 core banking system, as well as testing and reporting tools. Currently, Vjola works as a functional analyst focused on credit risk data integration and reporting within a project to centralize and modernize risk infrastructure, ensuring compliance with EU regulations. Her responsibilities include business requirements analysis, RWA calculation, regulatory reporting, and data mapping. Before this role, Vjola worked in software companies specializing in banking and financial services as a Senior Product Specialist and Automation Test Engineer for core banking systems. She also progressed rapidly in previous positions, advancing from Business Analyst to Project Manager.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support