Written by Kristian Lajkep, Consultant

Reviewed by Silvio Santarossa, Partner

Under the 2019 European Green deal, the EU has committed itself to become carbon neutral by 2050 and to reduce its emissions by 55% by 2030. These goals were adopted to combat wide-reaching adverse climate changes. Even if they are achieved, much harm has already been done and the world economy will be under significant pressure. The 21st century will be a century of volatility. The typhoons in south Asia are expected to grow three folds in magnitude and venture into the places they were hitherto unseen. Adapting to the future climate-related challenges is going to be crucial.

Against the backdrop of COVID 19 pandemic, the EU has released a taxonomy package intended to support climate change mitigation/adaptation goals. The timing of this release was not incidental – whilst there is no specific connection between COVID 19 and climate change, the WHO periodically issues warnings that the climate change may lead to increased likelihood and severity of global pandemics. It became apparent that in the global crisis the fortune favours the prepared mind. Countries that had previous acquaintance with SARS-like diseases were more efficient than the western countries with their state-of-the art healthcare. A capacity of countries to mobilise their populations, coordinate their efforts and shoulder a significant economic cost in preventing a disaster was also tested. The lessons of 2008 were notable influence: the governments of the world are determined to respond with more stimulus for swifter recovery from the crisis.

Having received a precourse to what may happen in the future and being set to invest themselves out of the present troubles, the European countries decided to release a taxonomy regulation to help them identify the investments that are contributing to their climate goals.

The two major green goals are:

- To reduce the human contribution to the climate change and avoid future adverse impacts. This is referred to as climate change mitigation.

- To improve the resilience of our society so that when the adverse effects of the climate change will arrive, our society will be equipped to withstand and palliate them. This is known as the climate change adaptation.

These goals are the biggest, broadest, and currently most well developed. However, in addition, there are four more concrete goals:

- Sustainable use and protection of water and marine resources,

- Transition to circular economy,

- Pollution prevention and control,

- Protection and restauration of biodiversity and ecosystems.

What types of investments are considered by taxonomy?

The goal of taxonomy is to provide a common platform to identify and classify the investments that are consistent with the climate goals. Aside from passing the technical screening criteria provided through delegated acts, there are several key characteristics, that the investments should have to qualify under taxonomy. These are:

Significant contribution to one of the goals

Significant contribution relates to the merits that an investment should have to support their respective taxonomy goals. These merits can be broadly divided into:

Low carbon investments – products or processes that release fewer emissions than those previously in use. Such as investments in wind, solar, 0% emissions transport or afforestation.

Enabling mitigation investments – Investment in products or technologies that are not low carbon themselves but contribute to the supply chains of low carbon investments. For example manufacturing of wind turbines or triple glass windows.

Transitional Criteria – Activities which have no current feasible green alternative, and which support a future transition to low carbon alternative. Several transitional criteria are initially generous but will become less so every 5 years.

Resilience-related investments – Activities that integrate measures to allow better performance under changing climate. This includes investments in retaining water in soil or flood preventing dams.

Enabling Adaptation Investments – Investments that support other adaptation activities. This includes satellite systems for water observations, consulting services for climate risk assessment or insurance for extreme weather events.

Do No Harm to any of the goals

Do no significant harm criterion relates to the features that an investment cannot have under taxonomy even if it makes a significant contribution to one of the climate goals. This is to ensure that a progress towards certain environmental objectives is not made at the expense of others. This disqualifies the activities that:

- Lead to the increase of greenhouse gas emissions or have other negative effects on current and/or expected future climate.

- Are not resilient to climate change because not all material risks have been reduced as much as possible.

- Are delivered in a way that adversely affects the adaptation of others.

- Have a negative impact on the development of other low-carbon alternatives.

- Lock-in of the carbon intensive assets – create a carbon-intensive technology, which is costly and impractical to move away from.

Currently the technical provisions regarding ‘Significant Contributions’ and ‘Do No Harm’ are only developed for mitigation and adaptation.

Minimum Safeguards

The assumption underlying taxonomy is that more unified and equitable societies will be able to shoulder the climate shocks better. There is thus a desire to improve the societies’ resilience by protecting its most vulnerable members from the turbulence caused by the worsening climate conditions. For now, this policy requires the investors to comply with the most basic social and governance safeguards that should easily be fulfilled by most companies already. These requirements include:

- The OECD guidelines for multinational enterprises

- The UN guiding principles on business & human rights

- International Labour Organization’s declaration on fundamental principles and rights at work

- The international bill of the human rights

These requirements overlap, are principle-based, and therefore likely do not require a materiality assessment.

Taxonomy by Industries

The taxonomy covers about 90% of industries producing 93% of emissions with more to come. The current rules will be adjusted to accommodate future technology developments and their implementation.

We can broadly explain the conditions that the investments must meet within each industry as well as the strategies envisioned for given industry, which may become useful, when estimating the future developments. The approaches intend to be scientific and technology agnostic - they assign the taxonomy status without prejudice to other policies.

Electricity

Electricity is expected to be clean by 2050 and therefore, a substantial push is also made to make the most use of it. The grids should be improved and number of items, from stoves to cars are expected to swich to the electric power.

Technology agnostic threshold for electricity is set on 100 grams of CO2/KWH. This is a difficult threshold to be met with all but the cleanest energy sources. The solid fossil fuels (coal) were explicitly excluded even with 100% CCS. Gas and nuclear energy await further verdict with differing opinions across EU. It is however likely that gas with 100% CCS would qualify at least as a transition - some of the gas infrastructure can be used for hydrogen in the future. The hydro energy faces the notable problem of methane leakage and will be assessed at later date.

Proving the alignment will be relatively easy for wind and solar powerplants, but their geothermal counterparts may struggle with the lifecycle assessments. Still, these assessments concern the use phase only – which makes them relatively easy to pass.

Transportation

The new taxonomy calls for zero tailpipe (excluding embedded emissions) electric systems in personal transportation. Electricity is highly preferred over hydrogen, which is expected to find more use in metalworking and manufacturing industry. Bigger sized lorries, for whom the batteries would be inefficient, may need to use hydrogen. Electric Rail is also viewed as the essential.

The electricity is projected as sustainable. Some countries (Poland) produce most of their electricity from unclean sources. Nevertheless, recent study shows that even in Poland, electric car has a lower carbon footprint than a combustion engine one. Regardless, electricity is expected to become clear in the near future.

For the first 5 years, the taxonomy also allows for vehicles that produce less than 50g CO2/100km. This requirement is quite strict. It should be barely enough for plug-in hybrids to qualify, but it should exclude the ordinary hybrids.

Water & Waste Management

The importance of water may be underappreciated: pumping water alone consumes 7% of global electricity and water retention is going to play a significant role in climate change adaptation. Improvements in energy efficiency of pumps and supporting water retention or monitoring projects is a major part of taxonomy.

The investments on recycling, methane capture and other items also fall under this category.

Buildings

Buildings are the biggest asset class on the planet and their inclusion in taxonomy is guided by three criteria:

- The ownership/acquisition criterion - the investor can show that the building fits into the top 15% energy efficient buildings in a country.

- New buildings - the criteria will be tougher – it is better to renovate old buildings, rather than emissions-costly knocking down and rebuilding. For this purpose, a 0 % energy standard introduced a goal of net zero energy consumption of new buildings as of 2030.

- Renovations - investor needs to prove at least 30% improvement in energy efficiency for taxonomy to apply to all renovation costs. Smaller improvements fall under adaptation where it is possible to claim portion of project: I.e., Suppose a wall isolation work conducted on a flat. The work will materially lead to an improvement of overall energy efficiency, but not by 30%. It is still possible to claim the isolation work under taxonomy, but only for the works that led to the improvement, not for the entire flat.

The methodologies for assessing the energy efficiency buildings tend to focus on primary energy demand only, which makes the ambitious goals somewhat more attainable. Nevertheless, finding a consistent methodology across the EU will be difficult. As of now, the investors would have to find proxies.

Land Use

Relates to the management of natural carbon stocks. This consists of basket of activities. Improvements in agriculture (needle machines instead of ploughing), maintenance, improvements in afforestation.

Plantation forestry was completely excluded. As it is hard to assess its benefits and/or have confidence in utilization of proceeds.

Manufacturing

This relates mostly to enabling investments for other industries such as triple glass windows or wind turbines.

The areas that are going to need the biggest transition in manufacturing sector are concrete and metal production chains. Concrete constitutes a significant percentage of global carbon emissions. A low -carbon concrete is already in use in Belgium, but costs approximately 10% more making it a niche product. A concrete sector should however experience 40% reduction in emissions in the next 10-15 years.

The steel industry will need to transfer to green hydrogen or blue hydrogen with carbon capture.

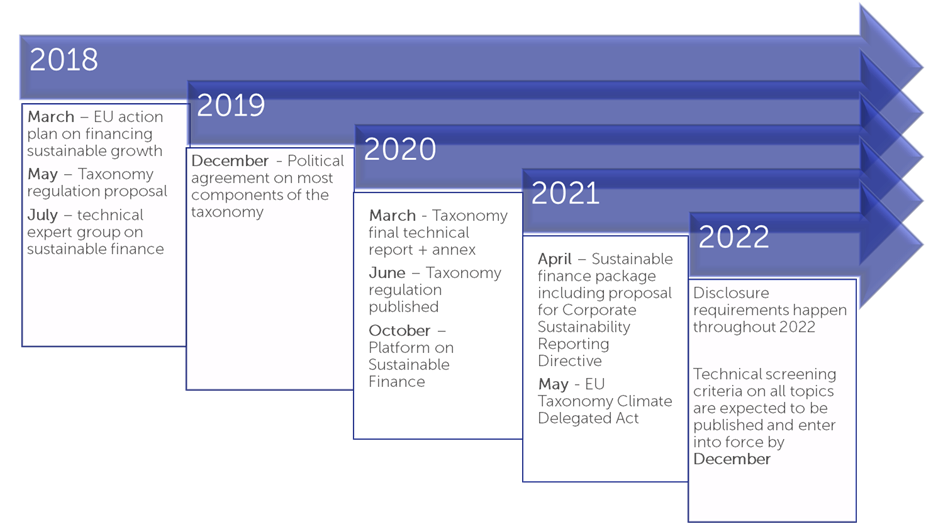

Disclosure Requirements

The financial market participants, such as banks, insurers, and investors are obliged to disclose what portion of their portfolios is taxonomy alignment. The corporations with over 500 staff that already are subject to Non-Financial-Reporting Directive must report on their sustainable investments. The companies that seek to acquire financing from the EU are also required to report on their taxonomy alignment as indeed are the member states themselves when setting public measures or issuing green bonds. Even the companies that are not obliged to report their taxonomy may elect to do so if the advantages from doing so prove to be attractive, particularly as regards raising funds.

The financial companies are to disclose their taxonomy alinement in their periodic reports, pre-contractual disclosures and on their websites before the end of 2021 for Climate Risk Mitigation and Adaptation and by the 2022 for all six objectives. The corporations are to disclose their taxonomy alignment in non-financial statement reports or in dedicated sustainability reports. Their deadlines copy the ones for financial institutions with a one-year delay.

It is assumed it would take about two years for institutions to get sufficiently familiar with taxonomy to include it on their systems. Initially the data is going to be a problem, but the major data providers have already announced projects to increase the relevant data availability – Sustainable Data Alliance.

The users will have to disclose the KPIs on the taxonomy-related economic activity in relation to turnover, capital expenditures and (if applicable) operating expenditures. The revenue from sustainable activities needs to be broken down in percentages. The products/services that are not aligned with taxonomy need also to be disclosed along with statement, that they do not concern the taxonomy regulation.

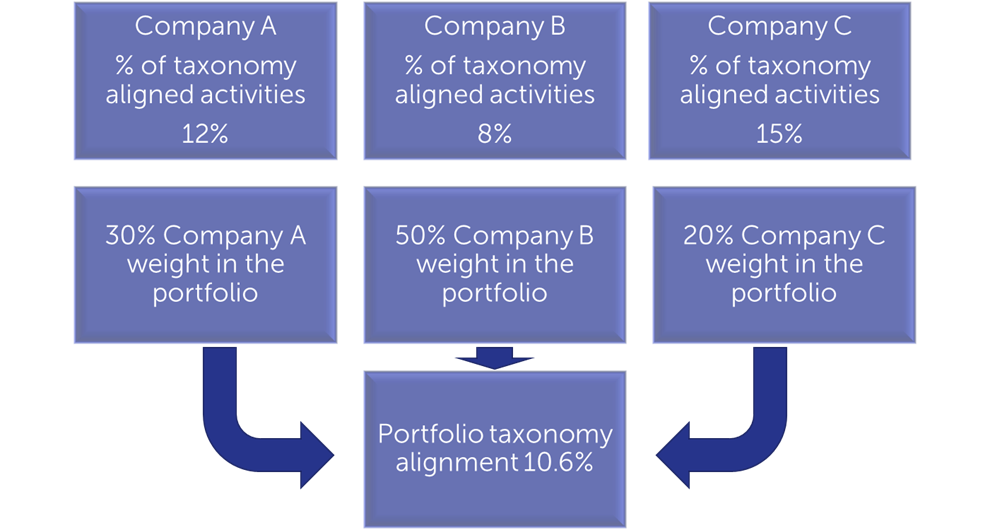

The investors should calculate their portfolio taxonomy alignment in the following way:

Incentives

One of the major questions surrounding the taxonomy, particularly for the financial institutions is not so much “What?” but “Why?”

Apart from the regulatory obligation, the institutions chiefly recognise the taxonomy alignment as one of the conditions for acquiring public money and subsidies. Making significant climatic harm may exclude company from an access to the public funds. Investing into taxonomy-aligned projects may entitle them to some additional subsidies.

For the financial sector, the appeal to engage in taxonomy is somewhat less pressing. Currently there is no particular incentive for banking institutions to hold a green portfolio. Some states, such as Hungary have taken to impose preferential capital requirements on the green mortgages, though this is not common practice. In 2020, the green bonds have already started limping into the market. Their issuance is dominated by the states, with relatively few private companies venturing to release them. It is unclear, whether purchasing or holding the green bonds will have any notable advantage for the financial institution. Given that they are mostly government issued and that the government bonds already have a preferential treatment, any other additional preferential treatment seems unlikely. The ECB has also made some remark about possible “green quantitative easing” but, if it ever happens, it is likely going to affect exclusively the green bonds released by the governments.

Finalyse InsuranceFinalyse offers specialized consulting for insurance and pension sectors, focusing on risk management, actuarial modeling, and regulatory compliance. Their services include Solvency II support, IFRS 17 implementation, and climate risk assessments, ensuring robust frameworks and regulatory alignment for institutions. |

Our Insurance Services

Check out Finalyse Insurance services list that could help your business.

Our Insurance Leaders

Get to know the people behind our services, feel free to ask them any questions.

Client Cases

Read Finalyse client cases regarding our insurance service offer.

Insurance blog articles

Read Finalyse blog articles regarding our insurance service offer.

Trending Services

BMA Regulations

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department

Solvency II

Designed to meet regulatory and strategic requirements of the Actuarial and Risk department.

Outsourced Function Services

Designed to provide cost-efficient and independent assurance to insurance and reinsurance undertakings

Finalyse BankingFinalyse leverages 35+ years of banking expertise to guide you through regulatory challenges with tailored risk solutions. |

Trending Services

AI Fairness Assessment

Designed to help your Risk Management (Validation/AI Team) department in complying with EU AI Act regulatory requirements

CRR3 Validation Toolkit

A tool for banks to validate the implementation of RWA calculations and be better prepared for CRR3 in 2025

FRTB

In 2025, FRTB will become the European norm for Pillar I market risk. Enhanced reporting requirements will also kick in at the start of the year. Are you on track?

Finalyse ValuationValuing complex products is both costly and demanding, requiring quality data, advanced models, and expert support. Finalyse Valuation Services are tailored to client needs, ensuring transparency and ongoing collaboration. Our experts analyse and reconcile counterparty prices to explain and document any differences. |

Trending Services

Independent valuation of OTC and structured products

Helping clients to reconcile price disputes

Value at Risk (VaR) Calculation Service

Save time reviewing the reports instead of producing them yourself

EMIR and SFTR Reporting Services

Helping institutions to cope with reporting-related requirements

Finalyse PublicationsDiscover Finalyse writings, written for you by our experienced consultants, read whitepapers, our RegBrief and blog articles to stay ahead of the trends in the Banking, Insurance and Managed Services world |

Blog

Finalyse’s take on risk-mitigation techniques and the regulatory requirements that they address

Regulatory Brief

A regularly updated catalogue of key financial policy changes, focusing on risk management, reporting, governance, accounting, and trading

Materials

Read Finalyse whitepapers and research materials on trending subjects

Latest Blog Articles

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 2 of 2)

Contents of a Recovery Plan: What European Insurers Can Learn From the Irish Experience (Part 1 of 2)

Rethinking 'Risk-Free': Managing the Hidden Risks in Long- and Short-Term Insurance Liabilities

About FinalyseOur aim is to support our clients incorporating changes and innovations in valuation, risk and compliance. We share the ambition to contribute to a sustainable and resilient financial system. Facing these extraordinary challenges is what drives us every day. |

Finalyse CareersUnlock your potential with Finalyse: as risk management pioneers with over 35 years of experience, we provide advisory services and empower clients in making informed decisions. Our mission is to support them in adapting to changes and innovations, contributing to a sustainable and resilient financial system. |

Our Team

Get to know our diverse and multicultural teams, committed to bring new ideas

Why Finalyse

We combine growing fintech expertise, ownership, and a passion for tailored solutions to make a real impact

Career Path

Discover our three business lines and the expert teams delivering smart, reliable support