Articles connexes

Comment Finalyse peut vous aider

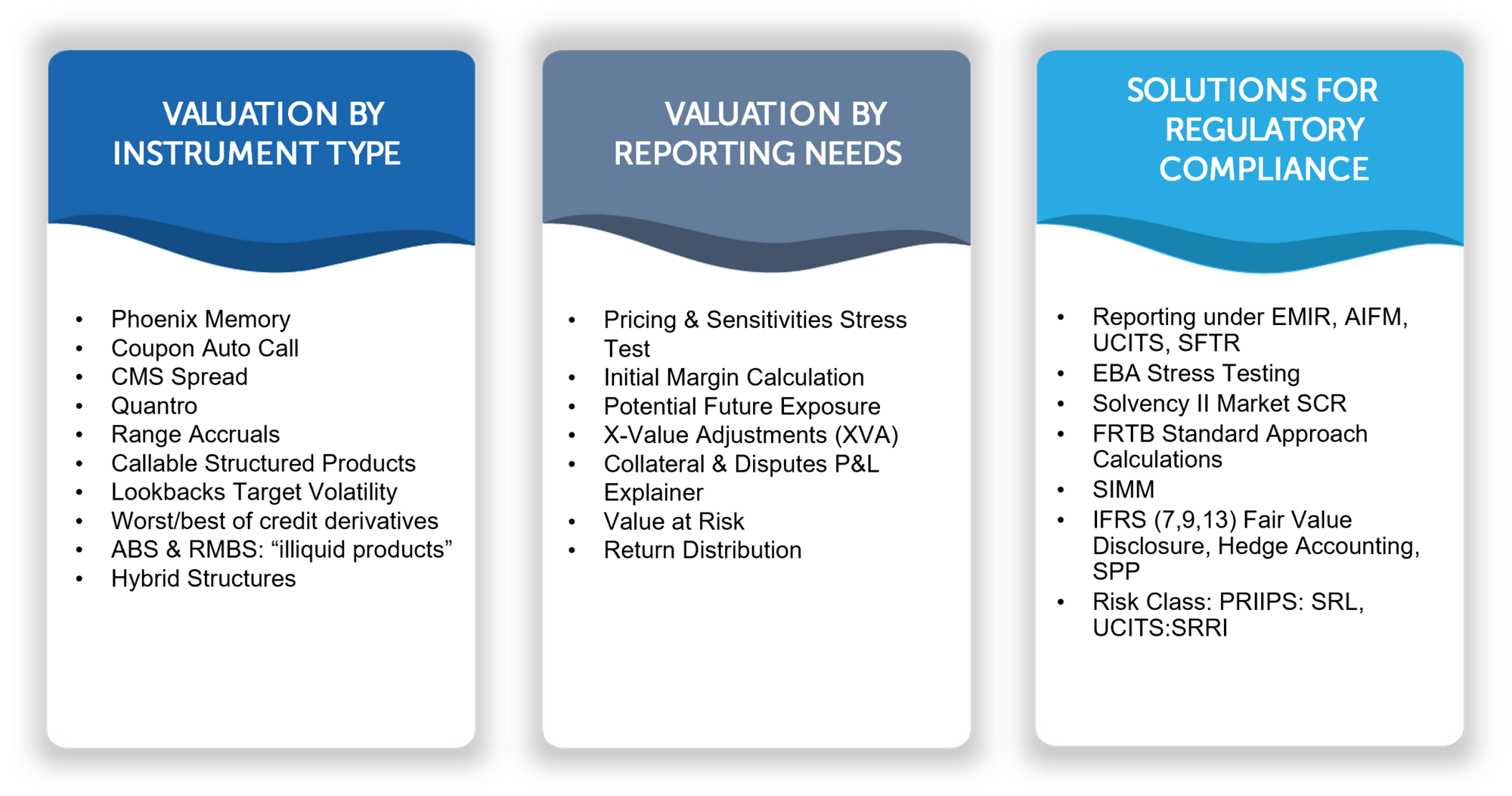

INDEPENDENT VALUATION OF STRUCTURED PRODUCTS AND COMPLEX OTC DERIVATIVES

Getting a fair valuation requires market data, complex models, a robust infrastructure, and a team of highly skilled professionals. Finalyse closely looks at each client’s case to provide a tailor-made service through specific financial models and customized reporting streams.

Comment Finalyse peut vous aider à relever ces défis ?

Market data handling

Robust market data process with quality checks is managed through integrated service with a flexible and adaptable data feed.

Best market practices

Using the best market practices, advanced modelling capabilities, and tailored to customer’s specific needs.

Price dispute resolution

- Price discrepancies investigation,

- A detailed report with analysis,

- A deeper investigation with the counterparties can be initiated.

Reporting

Granular and customised reports, ready to interface with your internal systems, with position history and audit trails.

Reconciliation

The dispute resolution versus counterparty prices, acceptance/rejection test, and gap analysis.

Personalised service

Unlike fintech solution providers, we begin with an in-depth evaluation of each client’s case. The account manager accompanies the client along every step.

Comment cela fonctionne-t-il en pratique ?

We begin with an in-depth evaluation of each client’s case. The account manager accompanies the client along every step.

- Pre-studies of the materials provided by clients

- Running a test valuation

- Accurate determination of the As-Is and To-Be business process

- Alignment with expectations and needs of the client at every step

- Service implementation

- Support

Finalyse valuation services team

Finalyse Valuation and Managed Services (FVS) unites dedicated experts in risk management, valuation, reporting and regulatory requirements.

Our consultants are advanced users of multi-purpose programming languages and professional quantitative modellers. The team consists of valuation and financial reporting analysts, BI analysts, software engineers, DBAs, financial engineers, and IT administrators.

Our technical knowledge allows us to implement the most convenient architecture for the clients. We perform a consistent development of the systems to keep them up-to-date and in line with the industry’s best practices, state of the art technology and latest regulatory developments.

Key Features

- A fully outsourced service to valuate the fair price of structured products and complex derivatives independently.

- Daily support: answering all your questions and demands on time.

- Regulatory compliance services linked to structured products and derivatives (EMIR reporting, initial margin SIMM based, SCR stress test for Solvency II).

- Detailed documentation for auditors and regulators, providing complete transparency (no black box).

- Calculation of risk figures: greeks, risk class, VaR, stress testing, P and L explainer.

- Calculation of Synthetic Risk & Reward Indicators (SRRIs) of UCITs.

- A detailed risk and sensitivities report for any structured product.

Ali, Partner at Finalyse, joined Finalyse in 2008 and founded the Valuation Services department.

With 25 years in the financial industry, including senior roles at top European banks, as head of structured products.

Now leading Valuation Services, Ali drives strategy and business development, adapting to market demands and client needs.

He's widely respected at Finalyse as an expert in Structured Products and OTC Derivatives, providing clients with advanced solutions in a dynamic financial landscape.

Guillaume prepares the valuation of structured products and OTC derivatives covering most asset classes. He acts as a Financial Engineer and maintains state-of-the-art pricing and modelling, steering model improvement and performing quality controls.

Guillaume contributed to developing the SIMM methodology's scenario simulations and market rate sensitivities. He implemented the replication valuation model for volatility swaps. He has been in charge of reviewing the methods used to build different issuer curves to improve them and the Solvency II TPT reporting for several clients.

Guillaume is also a CFA Charterholder.

Guillaume has five years of professional experience in the fair value measurement and sensitivities of OTC derivatives and structured products. He investigates our clients’ (FPS and EMIR) requests and reconciliation procedures with counterparties. As a Delivery Manager, he oversees the client deliveries follow-up and internal process improvements planning. Guillaume contributes to developing and maintaining the Finalyse Pricing Platform, creating solutions for the pricing and sensitivity measures (Greeks), valuation and Greeks automatization, EBA stress testing, SCR, FRTB, Margin calculation, backtesting automatization, and CRIF reports updates. His technical expertise covers financial software like Bloomberg and Thomson Reuters Eikon and programming languages like R and VBA.

Pedro has contributed to developing a new valuation tool in Python for the valuation of structured products, OTC derivatives, risk measures, and sensitivity measures. He is responsible for maintaining and developing new functionalities of Finalyse tools, such as the VaR tool.

Pedro gained extensive experience as a Business Analyst building and enhancing software to calculate credit risk and counterparty credit risk.

Client Testimonials

- Valuation of structured products and complex derivatives on a daily basis.

- Collateral & fair value.

- Scenario analysis and EBA stress tests.

- Decomposition of the multi legs prices (Capital, Option, Margin, Funding spread, etc.).

- Automatic feed via CSV and sftp.

- Reconciliation with counterparty and investigation.

- Valuation of structured products on a daily basis.

- Collateral & unwind.

- Reconciliation with counterparty and investigation.

- SCR calculation.